ZA FNB 994043 2011-2026 free printable template

Show details

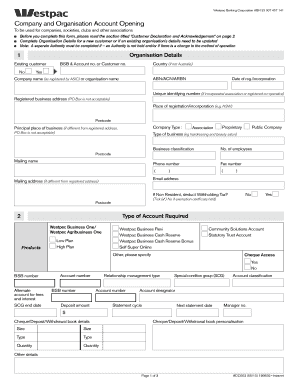

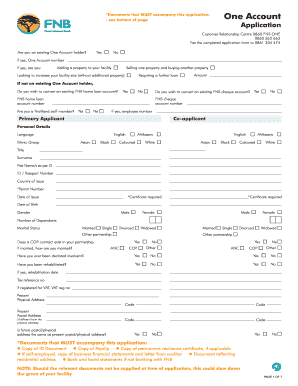

BUSINESS & CORPORATE NEW CONTROL ACCOUNT APPLICATION FORM Fax the completed application form to 011 371-1379 / 371-4510 or e-mail: nbpcommercialrequests FNB.co.ZA COMPANY DETAILS Doc. Ref. No.: BUSCCA001

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign new account application form

Edit your bank account application form pdf form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your bank account application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing business account opening form online

To use the professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit online bank account application form. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out online account opening form

How to fill out ZA FNB 994043

01

Obtain the ZA FNB 994043 form either online or at your local FNB branch.

02

Read the instructions carefully to understand the requirements for filling out the form.

03

Provide your personal information in the designated fields, including your name, address, and identification number.

04

Enter the necessary financial details as prompted, ensuring accuracy to avoid delays.

05

Review all entries for completeness and accuracy before submitting the form.

06

Submit the completed form either electronically or in person at your nearest FNB branch, as per your preference.

Who needs ZA FNB 994043?

01

Individuals applying for financial services or products with FNB.

02

Businesses needing to provide financial information to FNB for loans or accounts.

03

Anyone required to complete this form as part of regulatory compliance.

Fill

corporate account application form

: Try Risk Free

People Also Ask about opening account form

Do banks require an EIN?

Opening a business bank account is a smart way for small-business owners to separate business and personal finances. During the process, you'll likely discover that most banks require businesses to have an employer identification number, or EIN, to open a business checking account.

What is needed to open a Scotia business account?

Account Documentation Checklist Business License (Current) Certificate of Registration (If any) Business Plan or 12 Months Financials. Primary I.D.- PASSPORT or VOTER'S CARD <mandatory> and a Secondary <Driver's License or NIB Card> for all Signatories.

How do I open an EIN account?

Details you'll need to apply online: Business tax ID number: Business Employer Identification Number (EIN) provided by the IRS in the following 9-digit format XX-X. Sole proprietorships may use either their EIN or Social Security Number (SSN) Date business was established (month/year)

What are the 4 types of bank accounts?

Different Types of Bank Accounts in India Current account. A current account is a deposit account for traders, business owners, and entrepreneurs, who need to make and receive payments more often than others. Savings account. Salary account. Fixed deposit account. Recurring deposit account. NRI accounts.

Do you need EIN for business bank account?

The first thing you'll need is an employer identification number — also called an EIN, FEIN or tax identification number. The IRS issues and manages your EIN. If you haven't filed for a tax ID number, you may still be able to open a business bank account with your personal Social Security number.

Can you have a business bank account without EIN?

EIN number If you haven't filed for a tax ID number, you may still be able to open a business bank account with your personal Social Security number. Depending on your type of business, you may not need to apply for an EIN. A sole proprietorship with no employees typically doesn't require one.

What forms are needed to open a business account?

Get documents you need to open a business bank account Employer Identification Number (EIN) (or a Social Security number, if you're a sole proprietorship) Your business's formation documents. Ownership agreements. Business license.

What kind of bank account should I open as an LLC?

Anyone who forms an LLC should get a business bank account to help maintain liability protection for the company's members. One of the pros of forming an LLC (limited liability company) is having the protection that this business structure offers against creditors.

Do I need a business bank account for a sole proprietorship Canada?

If you operate under a registered business name, bill your clients and customers in the business's name. If your business has a name other than your own, you'll need a separate bank account to process cheques payable to your business.

What documents do you need to open a business bank account RBC?

A business registration document such as: Articles of Incorporation.One of three Government-issued IDs: Canadian Passport. Canadian Driver's Licence. Canadian Permanent Resident Card.

What is required to open a business bank account in Canada?

To get started, you will need personal information for all owners* as well as key details about the business. This includes personal ID, a document proving your company's business name, and your Canada Revenue Agency registration number, if you have one.

What bank is best for opening a business account?

Best Banks for Small Businesses of 2023 Best Overall: Chase. Best for Online-Only Checking: Axos Bank. Best Credit Union: Navy Federal Credit Union. Best Number of Branches: Wells Fargo. Best for Business Analysis: M&T Bank. Best Fee-Free Brick-And-Mortar Checking: US Bank.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get business bank account application form?

The premium version of pdfFiller gives you access to a huge library of fillable forms (more than 25 million fillable templates). You can download, fill out, print, and sign them all. State-specific business checking account application and other forms will be easy to find in the library. Find the template you need and use advanced editing tools to make it your own.

How do I fill out corporate application form using my mobile device?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign bank application form pdf and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

How do I edit new account application form on an Android device?

With the pdfFiller Android app, you can edit, sign, and share form to open a bank account on your mobile device from any place. All you need is an internet connection to do this. Keep your documents in order from anywhere with the help of the app!

What is ZA FNB 994043?

ZA FNB 994043 is a specific financial reporting form used in South Africa, typically related to tax compliance or financial declarations.

Who is required to file ZA FNB 994043?

Individuals or entities involved in financial transactions that fall under the jurisdiction of South African tax laws may be required to file ZA FNB 994043.

How to fill out ZA FNB 994043?

To fill out ZA FNB 994043, gather necessary financial information, follow the provided instructions specific to the form, and ensure that all required fields are accurately completed.

What is the purpose of ZA FNB 994043?

The purpose of ZA FNB 994043 is to ensure compliance with tax regulations and to report financial information to the relevant authorities.

What information must be reported on ZA FNB 994043?

ZA FNB 994043 typically requires reporting information such as income, expenses, taxes paid, and other financial data relevant to the taxpayer's situation.

Fill out your ZA FNB 994043 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Bank Registration Form is not the form you're looking for?Search for another form here.

Keywords relevant to new account form

Related to account form

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.